Coppel Access

Role

UX Lead / UI Designer

Duration

15 Months

Year

2022 - 2023

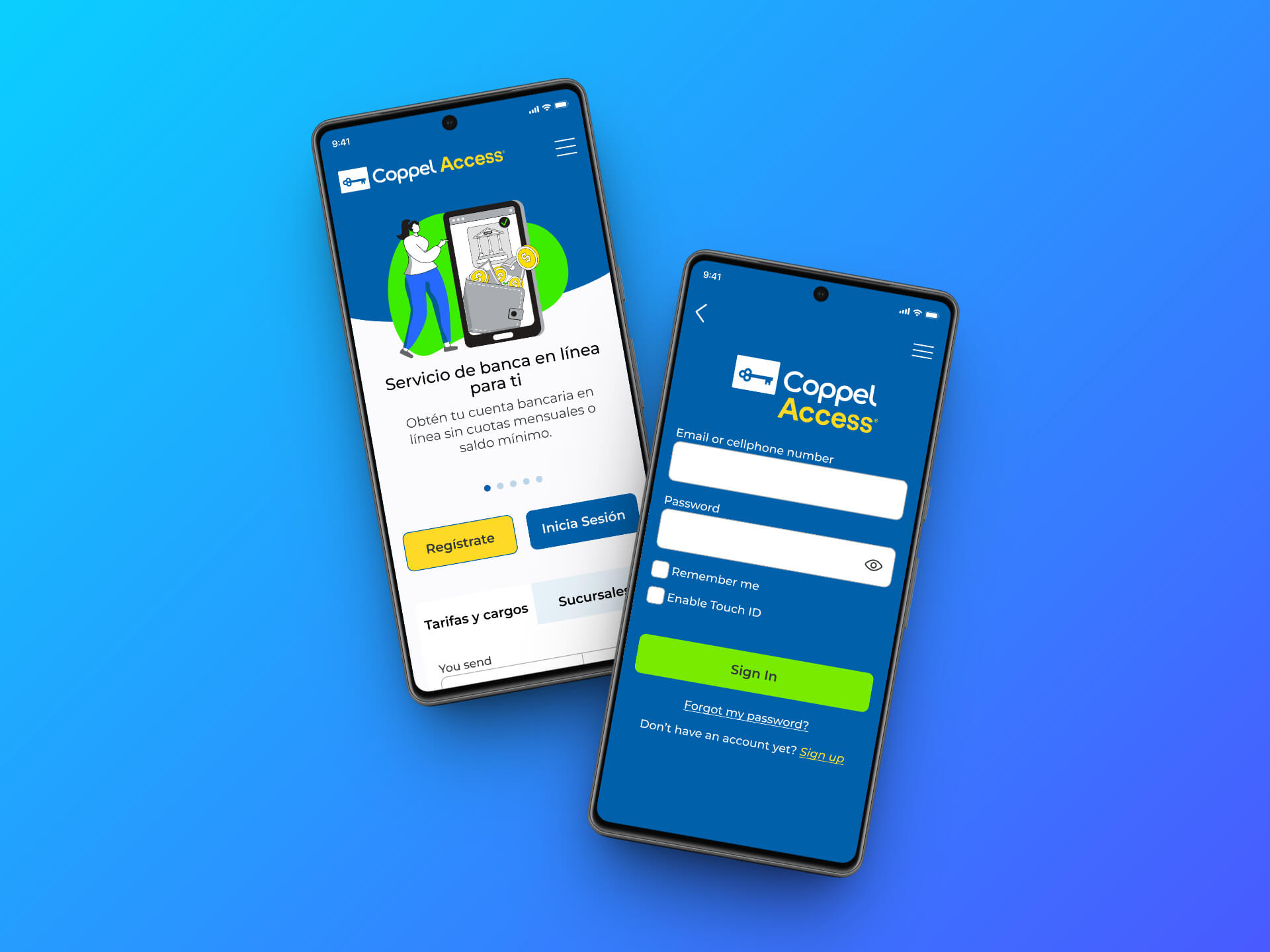

Coppel Access

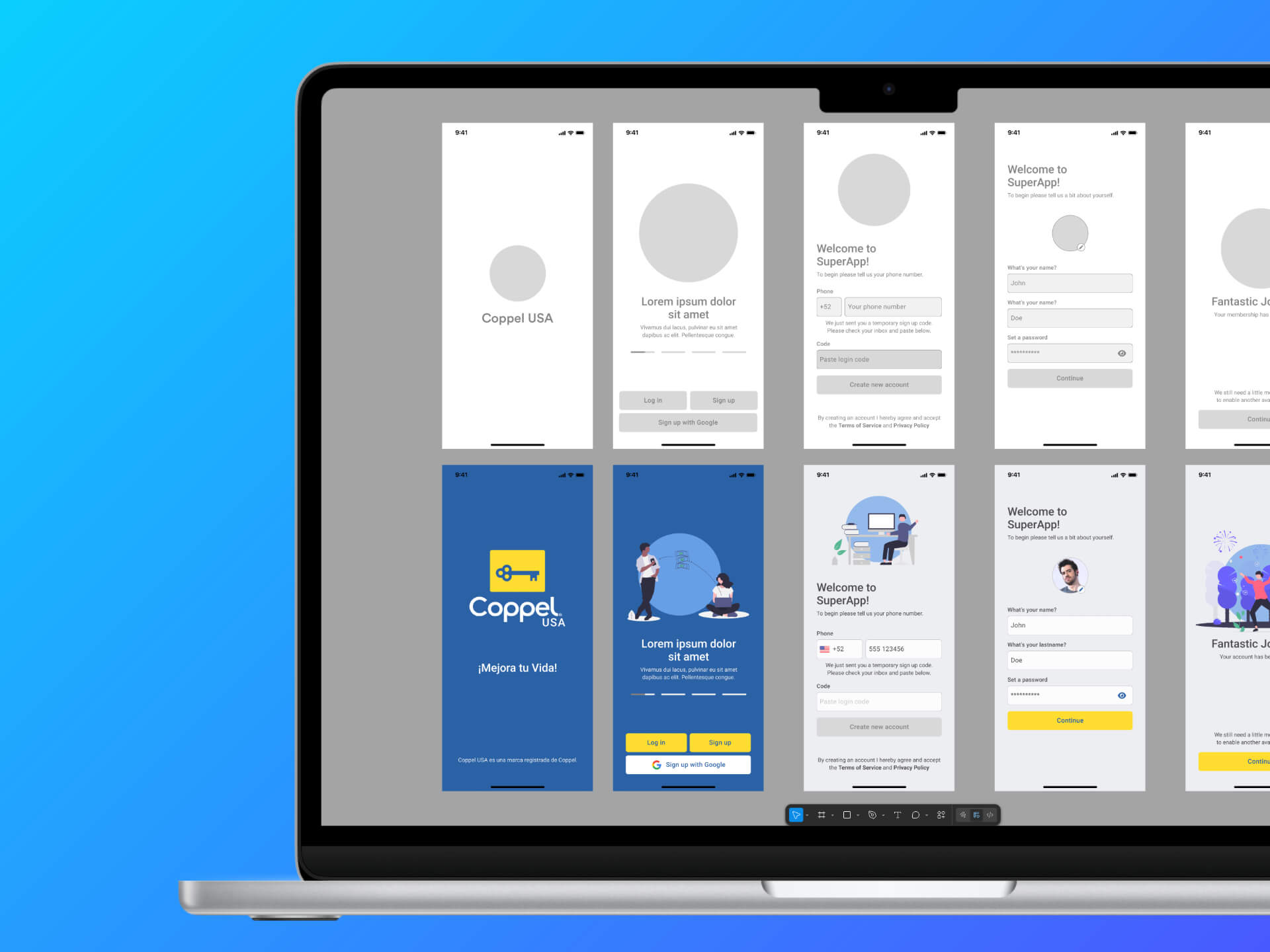

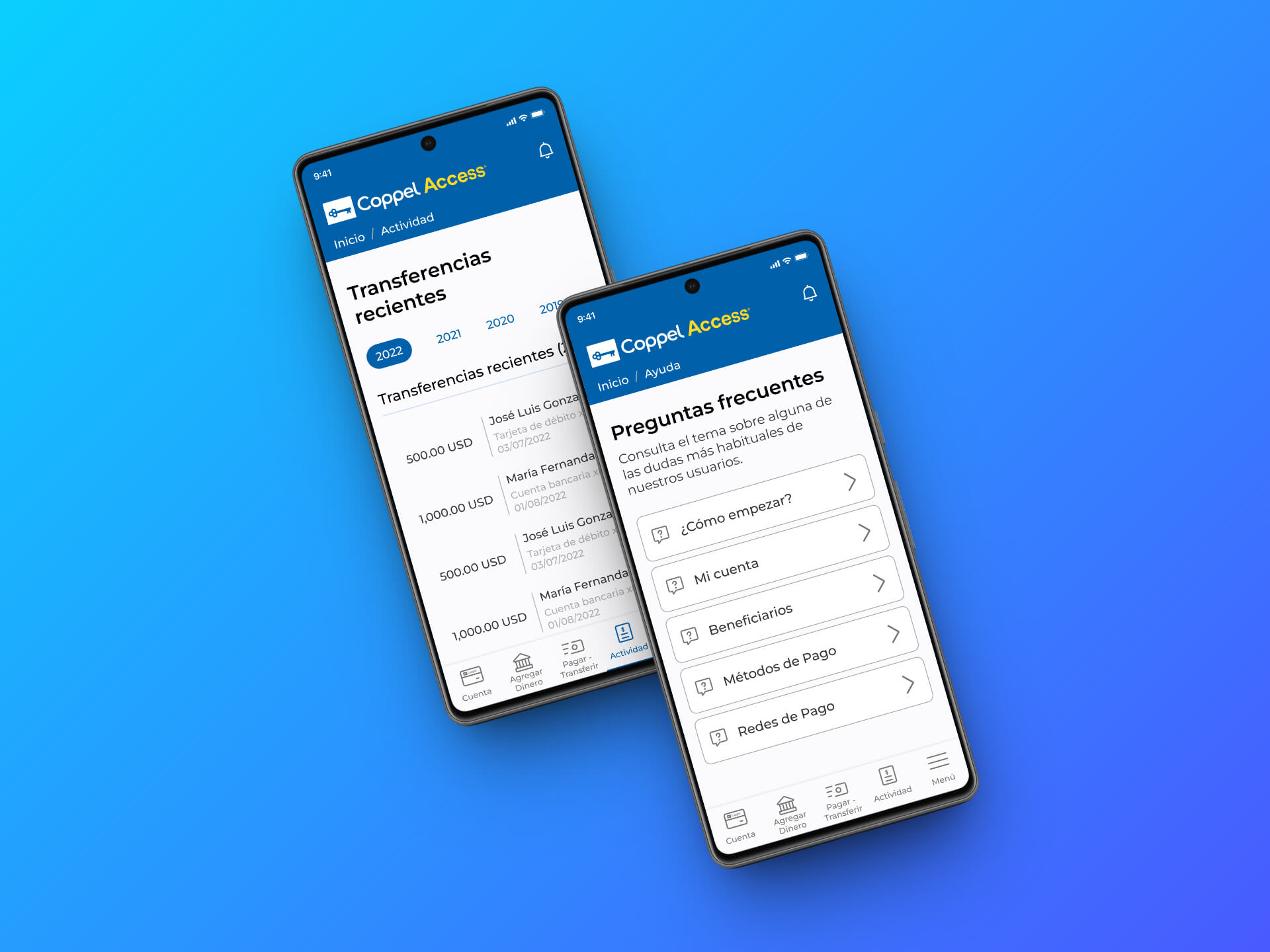

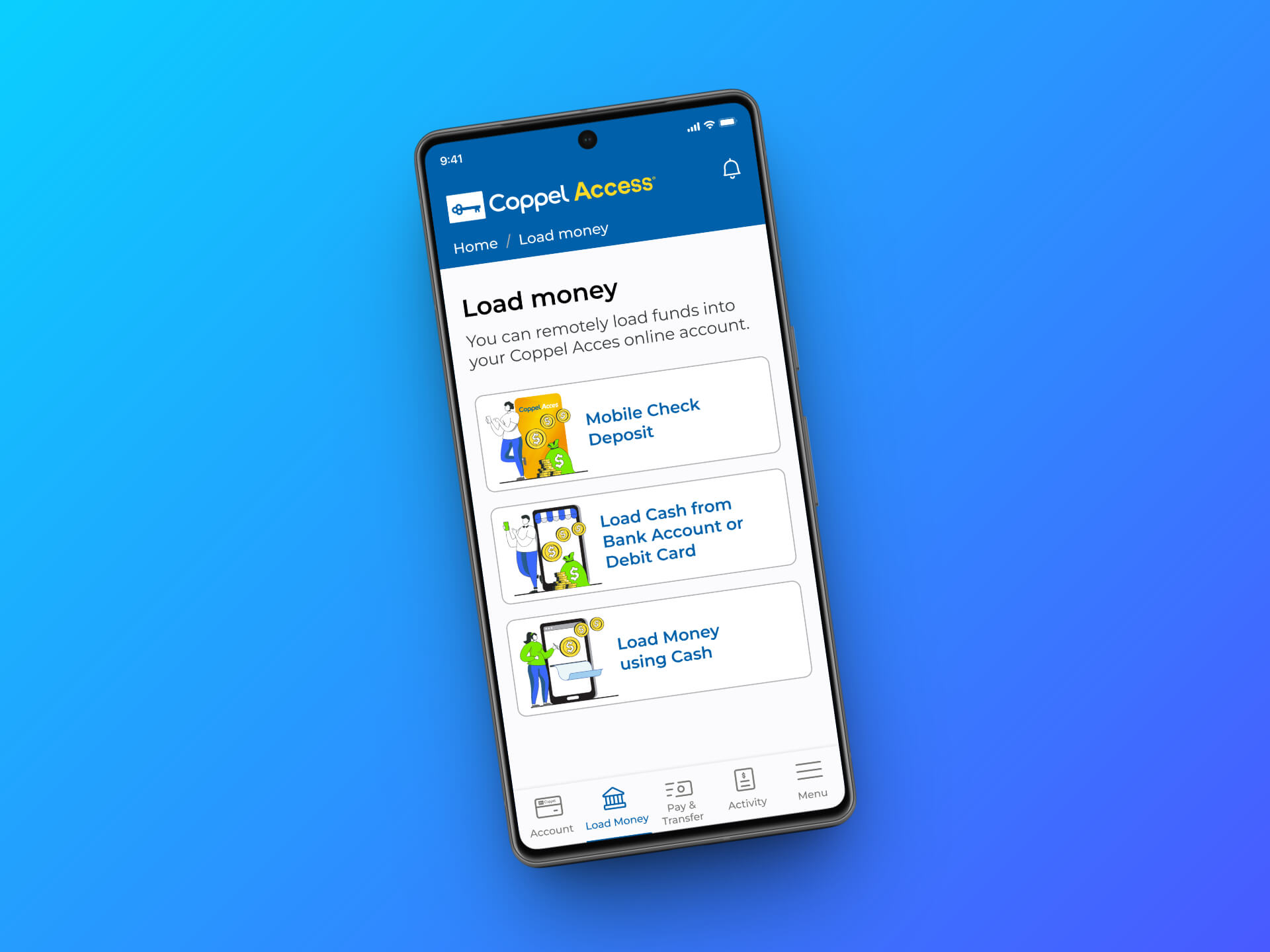

Initially called Coppel USA, it’s a digital banking mobile application developed by ApprizaPay, a fintech company specialized in online financial transactions.

Overview

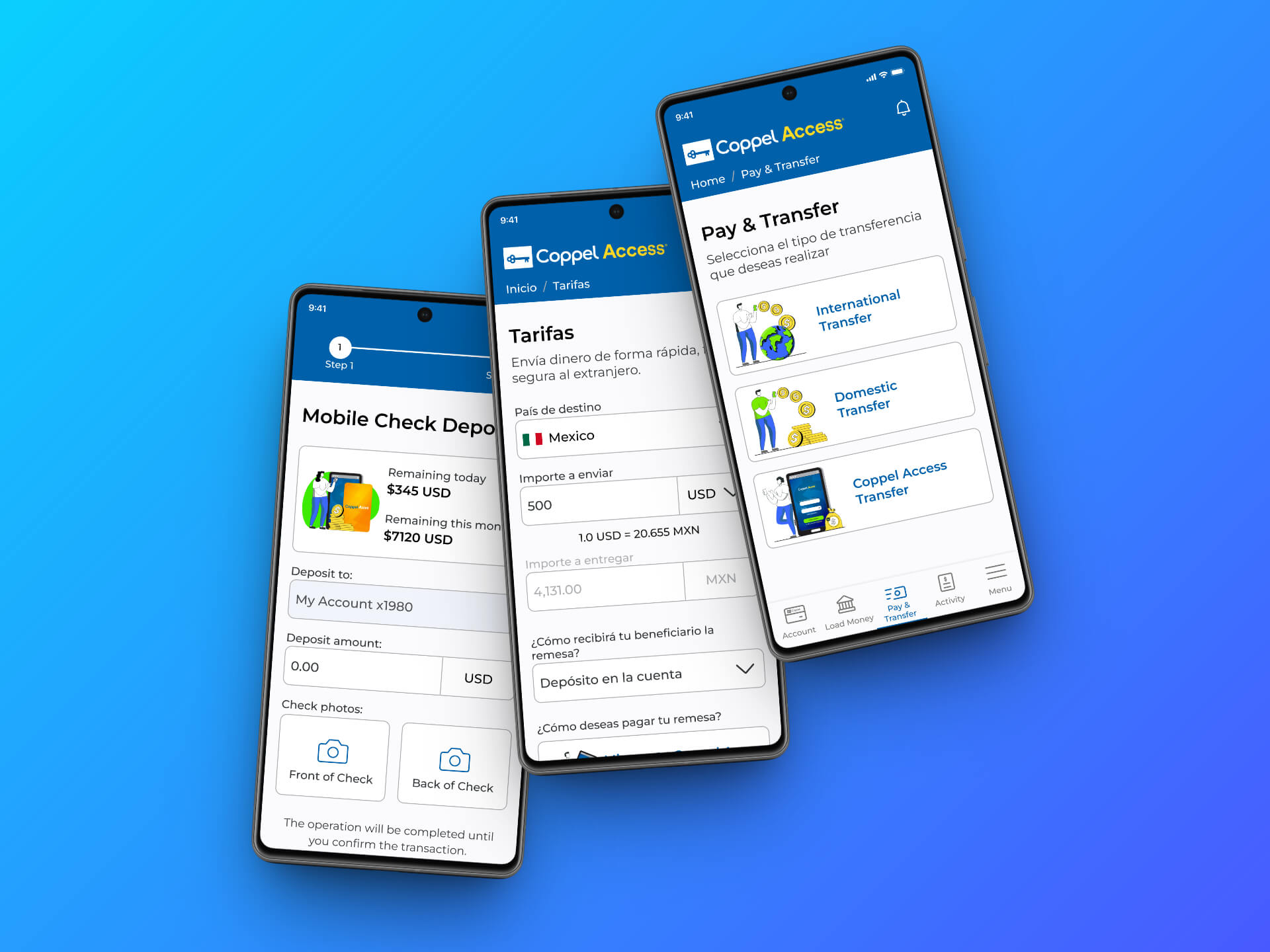

The mobile application provides Mexican immigrants in the United States, regardless of immigration status, with a safe and accessible solution for saving money, using a debit card, and sending remittances to Mexico. All funds are FDIC insured, with no monthly fees or minimum balance required.

Main Objective

Specific Objectives

- Build trust and transparency through FDIC-backed security and compliance.

- Optimize the remittance flow by reducing costs and transfer times compared to competitors.

- Design a mobile-first experience for both Android and iOS users.

- Provide a financial ecosystem that covers saving, payments, and international transfers.

- Simplify the flow processes for users with limited digital banking experience.

Measuring Success (KPIs)

Quantitative KPIs

Onboarding Conversion

% of users who complete registration.

Onboarding Time

Average minutes to open an account.

Transfers per User

Average monthly remittances per user.

Remittance Volume

Total money sent through the app wallet.

Retention (30/90 days)

% of users who stay active after sign-up.

Platform Adoption

Comparison of usage between Android and iOS.

Qualitative KPIs

Trust Perception

User sense of safety and reliability.

User Satisfaction CSAT

Feedback after completing transactions.

Ease of Use

Task success rate in usability tests.

Net Promoter Score NPS

Likelihood of recommending the app.

Background

Remittances from the United States to Mexico represent a critical market, traditionally dominated by players like Western Union, MoneyGram, and Wells Fargo, all of which require legal US documentation to operate.

This scenario excludes thousands of undocumented immigrants who face legal barriers and fear of deportation when visiting physical remittance agencies.

Opportunity Insight

A mobile app that allows users to save money, cash checks, pay with a debit card, and send remittances directly to Coppel stores in Mexico. This combines the trust of a recognized retail brand with the speed and simplicity of a digital service.

Findings

- Fear of Agencies: Users avoid physical remittance centers due to fear of deportation.

- Low Digital Banking Literacy: Many users have little or no prior experience with online banking.

- Brand Familiarity: Coppel stores generate immediate trust among Mexican users.

- Debit Card Value: A physical debit card is perceived as more reliable than digital-only options.

- Platform Demand: Strong user presence on both Android and iOS requires dual-platform support.

Pain Points

Legal Barriers

Competitors require US documentation that many users lack.

Strong Competition

Western Union and MoneyGram dominate the remittance market.

Low Trust in Fintechs

New apps are often met with skepticism about safety.

Overwhelming Interfaces

Users with low digital literacy struggle with complex flows.

Complex Onboarding

Account verification is slow and not fully intuitive.

User Needs

1.

Clear assurance of security, legality, and reliability.

2.

All flows and communications in clear Spanish.

3.

Immediate or near-instant money delivery to Mexico.

4.

No minimum balance or hidden monthly fees.

5.

An easy and quick way to create an account.

Why?

Mexican immigrants in the United States, especially those without legal documentation, face barriers to accessing financial services and sending money to Mexico in a secure and fast way. Lack of trust, complex onboarding, and restrictive legal requirements leave them with limited and often risky options.

Problem Statement

Mexican immigrants in the United States need an accessible, secure, and easy way to save and send money to Mexico without facing legal barriers or complex processes, so they can support their families quickly and confidently.

🚨

The Problem

Mexican immigrants in the US lack simple, safe ways to save and send money. Legal barriers and fear exclude them from traditional services.

🌎

Context

Remittances from the US to Mexico are massive, but key players require legal docs. Undocumented immigrants remain left out of the system.

Audience

Coppel Access serves Mexican immigrants living in the United States who need safe, fast, and affordable ways to manage their money, save, and send remittances to their families in Mexico. Many of them have limited access to traditional banking due to legal barriers or fear of deportation, while others simply seek a more convenient and trusted alternative. The audience includes both documented and undocumented individuals who often have low to medium digital literacy and value simplicity, security, and support in Spanish.

Target Users

Mexican immigrants living in the United States.

People who send money regularly to family in Mexico.

Users with low to medium digital literacy.

Undocumented immigrants without US banking access.

Individuals seeking trust, speed, and low fees.

User Persona #1

José Guadalupe Ramírez

Bricklayer

"I work hard to give my children opportunities I never had."

Bio

A devoted husband and father of four, he crossed the border 3 years ago, driven by the hope of building a better future. Today, he works by building houses.

Age: 34 years

Marital status: Married

Education: Basic

Personality traits:

Responsible

Hardworking

Honest

Family-oriented

🎯 Goals / Needs:

- Send money home quickly.

- Keep his savings safe.

- Use an app in Spanish.

😣 Pain Points:

- Complex onboarding processes.

- High remittance fees.

- Fear of sharing personal data.

🙈 Frustrations:

- Long waits for money transfers.

- Banks asking for legal documents.

- Apps that feel too complicated.

💪 Motivations:

- Support his family in Mexico.

- Save for future stability.

- Trust a service backed by a known brand.

User Persona #2

Benita Hernández

Restaurant cook

""I miss my father, but I stay because my son deserves more than I had."

Bio

A single mother with one child, she has lived in the United States for 14 years. She works as a cook at a local restaurant in San Diego.

Age: 38 years

Marital status: Single

Education: Primary

Personality traits:

Caring

Resilient

Practical

Family-oriented

🎯 Goals / Needs:

- Support her parents financially.

- Provide stability for her son.

- Use an app to not waste time.

😣 Pain Points:

- Struggles to balance work and family while managing finances.

- Finds it difficult to compare remittance options clearly.

- Limited trust in new apps.

🙈 Frustrations:

- Gets annoyed when transfers take longer than expected.

- Feels stressed when asked for too many requirements.

- Apps that feel too complicated.

💪 Motivations:

- Care for her parents in Mexico.

- Secure a better life for her son.

- Find a reliable, affordable way to manage money.